Peru's Illegal Mining Highlights Security and Environmental Risks

Short on time? Get a quick rundown of today’s top stories from the ACR:

Illegal mining in Peru poses increasing security risks and costs, with criminal gangs causing billions of dollars in losses, surpassing drug trafficking, and contributing to pollution, deforestation, and threats to Indigenous communities.

The Biden administration has proposed tax credits for hydrogen producers to support the industry and promote cleaner energy, although concerns about insufficient infrastructure and limited eligibility criteria have been raised.

Peru's Illegal Mining Highlights Security and Environmental Risks

In Peru, a recent deadly attack on a gold mine has brought attention to the increasing security risk and costs associated with illegal mining. Criminal gangs that target mines have caused billions of dollars in losses for the industry. According to government data, the amount of money moved annually by illegal mining in Peru is estimated to be between USD 3 and 4 billion, surpassing the amount moved by drug trafficking, with annual losses reaching approximately USD 6 billion. The government's attempts to formalize artisanal miners have unintentionally contributed to the growth of illegal mining. Furthermore, in the Loreto region of Peru, illegal gold mining is leading to significant pollution and deforestation, endangering waterways and Indigenous communities. Indigenous leaders are courageously fighting to protect their territories, but they face intimidation and threats from illegal miners. Addressing this complex challenge requires efforts to safeguard the Amazon and its Indigenous inhabitants from the involvement of armed groups.

Biden Administration Proposes Tax Credits to Boost Hydrogen Industry

The Biden administration has proposed offering tax credits to hydrogen producers in order to bolster the industry and promote cleaner alternatives to fossil fuels. The proposal introduces a tiered system where cleaner energy projects receive higher credits. It is estimated that these credits will generate USD 140 billion in revenue, create 700,000 jobs by 2030, and facilitate the production of 50 million metric tons of hydrogen by 2050. However, concerns have been raised regarding the insufficient infrastructure for delivering hydrogen to industries that could benefit the most. Additionally, the proposed regulations for the clean-hydrogen tax credit exclude existing nuclear power plants and only grant the credit to hydrogen produced using renewable power that has been brought online within the last three years.

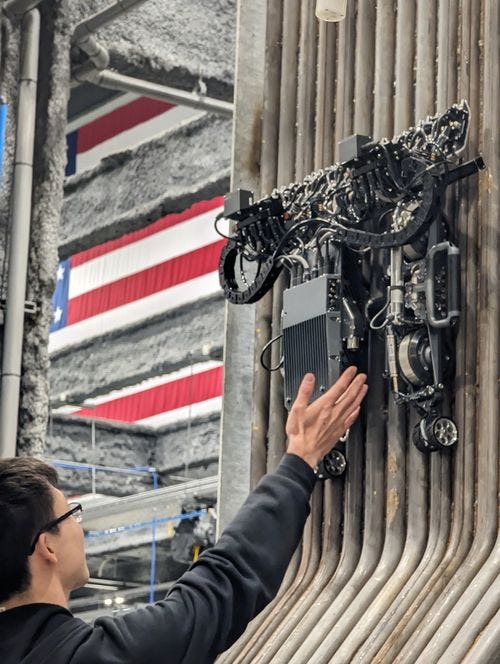

Gecko Robotics is a Pittsburgh-based company that specializes in building inspection robots and software for assessing the safety and condition of infrastructure. Their robots, powered by artificial intelligence (AI), are used in industries such as defense, oil and gas, manufacturing, and energy.

The company's technology helps preserve and maintain the current energy infrastructure by reducing asset failure, maximizing fuel sources, and avoiding costly environmental remediation. With a recent USD 100 million funding round, Gecko Robotics plans to use the capital for software and hardware acquisitions.

Saving (For) The Planet: The Climate Power Of Personal Banking

Publisher: Project Drawdown

Publication Date: December 2023

Access the report here.

This report highlights the climate impact of existing financial institutions and the benefits of low-carbon banking, including in the United States. It provides strategies for individuals to assess their banking footprint, engage with their bank, and move their money to climate-responsible institutions. The report emphasizes the importance of redirecting funds from fossil fuels towards climate solutions. It also mentions that none of the largest U.S. banks have aligned their practices with a 1.5°C scenario, despite making pledges to do so. Moving money to a more climate-responsible bank is a strategy worth considering, and there are several steps to ensure that all banking needs are met.